Reconciling your payroll bank account is the process of comparing the general ledger payroll account balance to your bank statement. The biggest difference between a PEO and a payroll company is that with a PEO you enter into a co-employment agreement.

Do You Know The Difference Between Salary Total Compensation Well You Should Because Understanding Pay In 2022 Understanding Understanding Yourself Compensation

Use the following steps to reconcile payroll.

. To put it simply it works like this. Payroll refers to the system employers use to process salary payments. At a high level there are three documents.

The income statement records expenses at the same time as related revenues are earned. Wages direct remuneration for services is referred to as wages. Match each hourly employees time card to the pay register.

Employer contributions and taxes. The information the IRS has and what you report on your return is not instantly matched up. It also includes keeping records on those payments and paying taxes on behalf of those employees.

These three groups are combined to form the gross payroll cost. The key types of payroll journal entries are noted below. A profit and loss PL statement summarizes the revenues.

Payroll Journal Entry Example 1. And the employees net pay. The first group is the traditional arrangement between the employer and the employee the agreed to wage.

Common pay stub deduction codes include the self-explanatory 401K for retirement savings contributions and 401K ER which refers to an employers contribution if the employee receives a company match. While you remain in control of all the day-to-day decisions your PEO provider will handle pretty much everything that an in-house HR team. The max taxable income for an individual is 110100 for OASDI but for HI the total income is taxable.

This agreement allows you to share some of the responsibilities of being an employer. The difference between the gross pay and the net pay is the taxes that were withheld from the employees pay. You need to reconcile payroll each pay period before checks actually go out as its much harder to correct any mistakes once people have gotten paid.

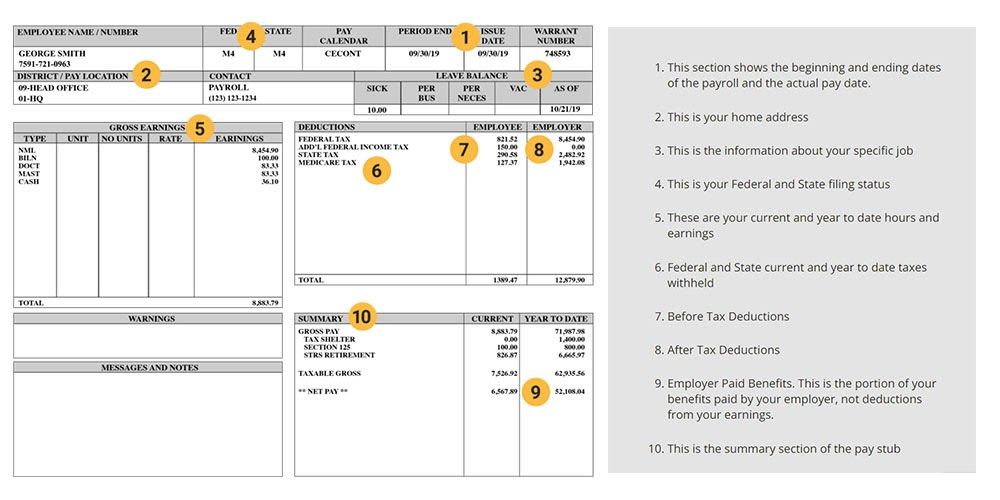

When you manage payroll your company incurs two types of payroll obligations. A document that details the employees gross wages taxes and deductions. When youre reconciling payroll for a specific pay period youll need to look at your employees time cards or timesheets for that span of time.

The truth is that unless there have been no deductions taken from a paycheck an employees last pay stub and W-2 form will almost never match. Yes you can still efile. This is called a true-up contribution.

The employer does not match the Additional Medicare Taxes that were withheld from the employees paychecks. Payroll is the function of a business paying its employees. If your 4th Qtr payroll information is going to be filed correctly and that information will match what is on the business tax return you are ready to file.

1 It includes distributing money in the form of checks and direct deposits. Forms employers must file with tax agencies eg the IRS that summarize employee pay information such as wages and taxes. The matching principle is one of the basic underlying guidelines in accounting.

Payroll is used at the end of the fiscal year to assess annual employee wages. Issue Payment Reports to Supervisors. In accounting a liability is an obligation to pay an amount.

Also match the 2295 and remit the total of 4590 to the US. The reconciliation of payroll doesnt have to be difficult for small business owners. The balance sheet shows liabilities at the end of the accounting period.

The difference between the two balances may be due to checks issued that have not yet cleared the bank timing differences between your accounting month and the bank statement ending date or errors on either the bank statement. Government within a specified. The primary payroll journal entry is for the initial recordation of a payroll.

Confirm employee time cards. Notwithstanding the differences between actual pay and process they are also connected. 4 for OASDI 2.

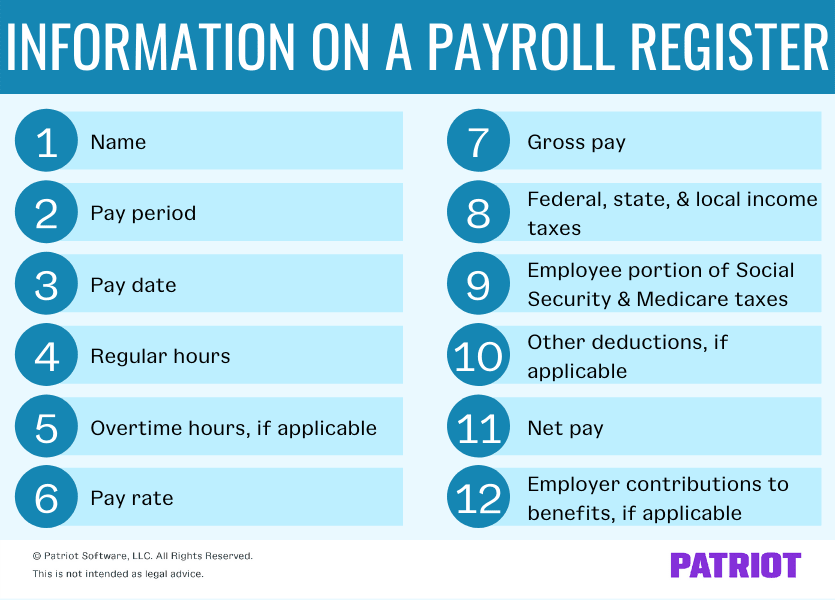

Amounts withheld from worker pay for income taxes must be forwarded to the. The payroll register shows gross wages deductions and net pay and so is a good summary document from which to trace. Match Payroll Register to Supporting Documents.

The second group of costs is the various taxes and the third is benefits paid by the employer. Payroll is a necessary workplace function for employees to receive their earned compensation. Payroll journal entries are used to record the compensation paid to employees.

The quickest explanation for this difference is that the last pay stub and W-2 form will almost always show two different wages. Government by specific dates. To make life easier for the employees some employers will do an extra calculation after the end of the year.

In our previous example when the employee maxed out too early and only received 3800 in 401k match the employer will contribute additional 1000 in the following year to make up the difference. The gross wages owed to employees and independent contractors are payroll liabilities. Look for fluctuations in payroll-related expenses in the financial statements and then investigate the reasons for the fluctuations.

The first step is to make sure everyone is getting paid the right amount. This way the employees. Make sure your payroll register accurately reflects wages and hours.

Check to see if their hours are entered correctly and confirm that the hours on their timesheet match whats in your payroll register. These entries are then incorporated into an entitys financial statements through the general ledger. The matching principle directs a company to report an expense on its income statement in the period in which the related revenues are earned.

Further it results in a liability to appear on the balance sheet for the end of the accounting period. Since the forms are being corrected and filed. The matching principle is designed to maintain balance and consistency across the financial statements income statements and balance sheets.

Here is the payroll journal entry to record the payment of the paycheck. The employer must remit both the amounts of the FICA withholdings and the employers matching to the US. Examples include Form 941 and Form W-2.

This amount will be recorded as various liabilities. The payroll register summarizes each employees wages and deductions for the pay period. Salary refers to the amount of pay -- or remuneration -- an employee earns.

However this is by no means an exhaustive list. Usually the net business income of individual as shown in their income tax returns make up their net earnings from self employment for the purpose of the social security act. Below you will find some of the most common deduction codes that appear on your pay stub.

Example of FICA Matching. A balance sheet provides both investors and creditors with a snapshot as to how effectively a companys management uses its resources. Print out your payroll register.

What Are Payroll Deductions Article

What Does Pay Stub Pay Check Stub Salary Slip Or Payslip Mean

0 Comments